GST provides free Accounting & Billing Software for Small Business

Introduction

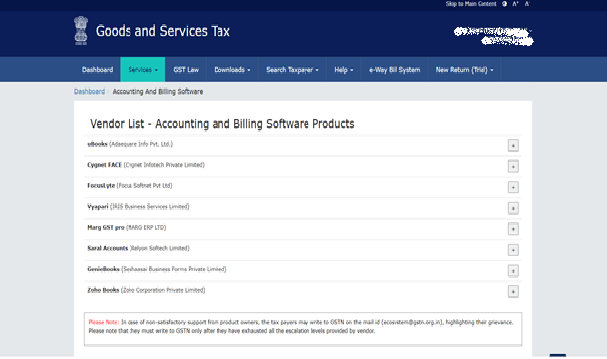

The GST network (GSTN) has started offering free accounting and billing software to MSME’s with annual turnover upto Rs 1.5 crore. This opportunity is said to benefit around 80 lakh small businesses. GSTN has partnered with 8 billing and accounting software vendors to provide this software to businesses upto turnover upto Rs 1.5 crore, free of cost. This software will help the MSME’s to move towards a digital system which will boost the effectiveness and efficiency of their compliance requirements.

This software would help businesses create invoices, account statements, prepare GST returns and manage inventory.

This facility is available to:-

- Active normal taxpayers

- SEZ developers/units

- Taxpayers who have opted for Composition scheme

The software would be available free of cost to eligible taxpayers till 31.03.2021 or till the taxpayer’s annual turnover remains under Rs 1.5 Cr in a financial year, after which the taxpayers may have to pay a fee to the vendor.

The steps to download the software are as follows:-

Features provided by the software:-

1.Provides the following ledgers (detailed item wise, period wise etc)

i. Sales ledger

ii. Purchase ledger

iii. Cash Ledger

2. Inventory management – batch wise, multi unit wise stock management

3. Generates sales/purchases receivable and payable report

4. Generation of invoices (multilingual invoicing option is available)

5. Generates of GST Returns

6. Generates mismatch reports, if any

7. Generates Profit and Loss and Balance Sheet

8. Provides a single user app for working online as well as offline

9. Provides item master with tax rates, rule changes, HSN rate

10. Facilitates item search by bar code, short code or description

11. Conducts automatic calculation of taxes payable

12. Keeps a track of customer/vendor orders

13. Provides customer/vendor outstanding report with age

14. Generates e-way bills from invoices

15. Provides for retail or wholesale GST billing

16. Conducts an internal GST Audit

17. Provides a mobile app with online access for invoicing, receipts and MIS reports

18. Provides route wise Van Distribution Reports

19. Generates budgets, targets, credit limits and cost centers for accounting

20. Prints invoices and ledgers

21. Easy migration of data from one accounting and billing software to another

22. Exporting of reports and data to excel, pdf or any other format as required for returns is available

GSTN Chief Executive stated that, “Such taxpayers are nearly 80 per cent in number under GST regime and thus this step is going to benefit a large number of taxpayers.”

It may be noted that only certain basic features of the software would be provided free. Some of the free features being made available by all the vendors are Sale/ Purchase/ Cash ledger, Inventory management, Supplier/ Customer Masters, Generation of Invoices, Preparation of GST Returns etc. For using features other than free features listed or using the software beyond the initial free period, the taxpayer may visit respective vendor product site to ascertain fee payable, if any.

Option of different Service Provider hire by GST